12 Aug July Post-Auction and Market Report

In July 2025, we hosted three online wine auctions:

- Cellar of a CEO Returns (2–6 July)

- Bastille Day – Vive la Révolution (9–14 July)

- Winter Rare & Fine Wine (23–27 July)

These closed on a total of 975 bottles across 565 lots.

Top Sellers

Due to the high demand for our specialist French Wine Auction to celebrate Bastille Day, our top five wines were all French and all came from the Bastille Day Auction:

- 2003 Domaine du Comte Liger-Belair Vosne-Romanée ‘Clos du Château’ ($1,650)

- 1985 Château Cheval Blanc x2 ($1,998 or $999 per bottle)

- 1996 Château Haut-Brion 1er Cru Classé ($900)

- 1996 Domaine Bonneau du Martray Corton Grand Cru en Magnum ($675)

- 2014 Domaine François Raveneau Forêt 1er Cru Chablis ($575)

New Zealand

New Zealand wines represented about one-third of our sales this month, with our top seller being a magnum of 2019 Te Mata Coleraine, which sold for $293.75, followed by a 5L of 2016 Coopers Creek Reserve Cabernet. Interestingly, all of our top 30 NZ sales (with the exception of a bottle of 2011 Craggy Range Aroha at $123.75) were NZ Bordeaux blends, including wines from Te Mata, Stonyridge, Puriri Hills, and Frenchmans Hill.

Despite the increased visibility of NZ Pinot Noir and Syrah, the stability and longevity of the classics (i.e., Bordeaux blends) means they continue to take centre stage in the secondary market. Some beautifully aged single-block Pinot Noir from Pyramid Valley also rounded out our $100+ sales.

France

With a specialist French Wine Auction to celebrate Bastille Day*, it is no surprise that French wine made up a significant portion of our sales — about 26% — with the top 20 sales represented by a relatively balanced mix of Burgundy, Bordeaux, the Rhône, and Champagne.

Australia

July put Australia somewhat on the back burner. However, there was considerable diversity in the offering, with top-flight Pinot Noir from Coldstream Hills and Domaine Epis fetching good prices, alongside wines from cult natural producer Ochota Barrels and more established names such as Penfolds, St Hallett, and Shaw & Smith.

Other Wines

When we look at our other sales, top-flight Italian wines were especially strong, with good sales of Super Tuscans, Barolo, and Barbaresco. This is a promising sign for vendors in our August The Italian Job auction starting on the 13th.

Other top sales included Vintage Port, American whiskey, Argentinian wines (especially Chardonnay), and Rioja.

Market Climate

The most important piece of news is that new (on top of the baseline 10% that have been in place since April) US tariffs have finally been imposed on many of the USA’s trading partners. Add in a growing antipathy toward US-made products and the Trump administration (plus retaliatory tariffs) across much of the world, and we are likely to see lower export demand for US-produced wines and spirits. While this has a primary effect on the wholesale and retail markets for wine, it will inevitably have a flow on effect to us in the secondary market.

- In the short term, expect to see a wider, more interesting selection of wines and spirits from around the world in the NZ market, especially from Australia, the EU, and also the USA. This echoes a similar effect post-covid. We saw a similar effect post-Covid.

- Expect the price of fine wine to rise (gradually). Producers all over the world tend to benchmark retail prices in USD, and as the shock of tariffs normalises, many will take advantage of this to increase prices in other export markets. We are seeing predictions of similar trends in other luxury markets (e.g., the watch market). This should make buying (and selling) on the secondary market (i.e. at auction) even more appealing.

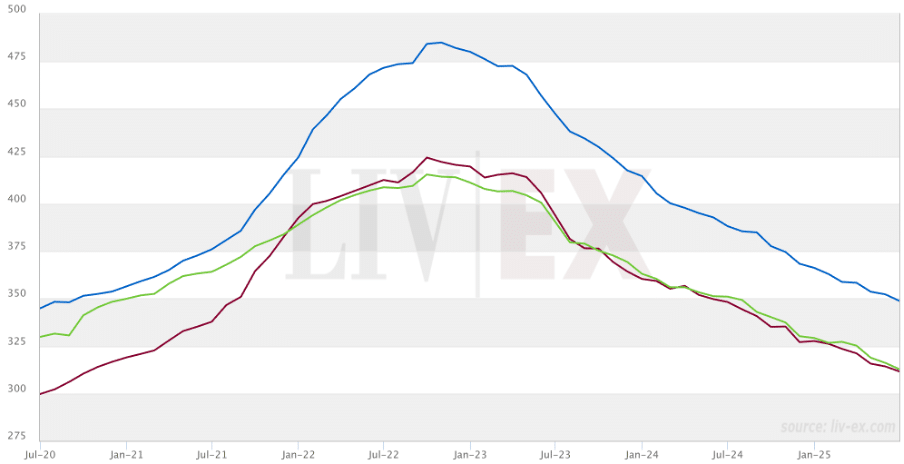

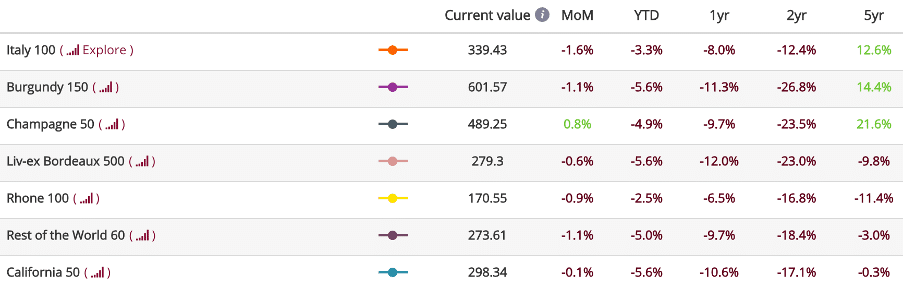

Liv-Ex Movements

While there is some improvement, Vinum is reporting that the international market for fine wine is still in decline, with index prices mirroring early Covid levels.

This said, the Liv-ex 100 and 1000 are still up slightly on early 2020 levels, in part due to growth in Champagne, Burgundy, and Italian fine wine prices.

The Market in Aotearoa

The story here is much the same: “It’s the economy, stupid.” RNZ reports small improvements to the NZ economy and that at least one major bank predicts it will be 2026 before significant growth occurs. We expect some increased economic activity toward the end of the year, which should help steady secondary prices for domestic wines and potentially fuel an increase in secondary prices as the market warms up again.

Takeaways and Investment Advice

- Buy now. The price of fine wine (whether domestic or imported) will start to rise again soon so if you’re thinking of stocking up on liquid assets now is a very good time to do so.

- Diversify. There is still strong sustained demand for fine wine from Italy (did we mention The Italian Job auction?) and France (with the exception of Bordeaux and the Rhone). These, as noted, performed well both internationally and in our July auctions.

- Hold. We think we’ve come through the worst of it in regards to the post-post covid price slump (which was a response a post-covid price bump) so a little bit of patience will pay off here.

* This is the second in a series of smaller, themed auctions we have curated, the first being our Trans-Tasman Wine Showdown in June. Interest has been strong, in part due to our reduced buyer’s premium of 12.5% for these events. The next in the series is The Italian Job auction, starting 13 August.

Please note: all prices quoted include the Buyers Premium (ex-GST)