12 Nov October Post-Auction and Market Report

In October 2025, we hosted three online wine auctions:

- September Rare & Fine Wine Auction (8 – 13 October)

- Single Vendor: The Cellar of Two Passionate Collectors (15 – 20 October)

- Pinot Envy: Pinot Noir and Friends (22 – 27 October

These closed on a total of 906 bottles across 564 lots. The strong results achieved in October exceeded our expectation and outstripped sales performance of previous months.

Top Sellers

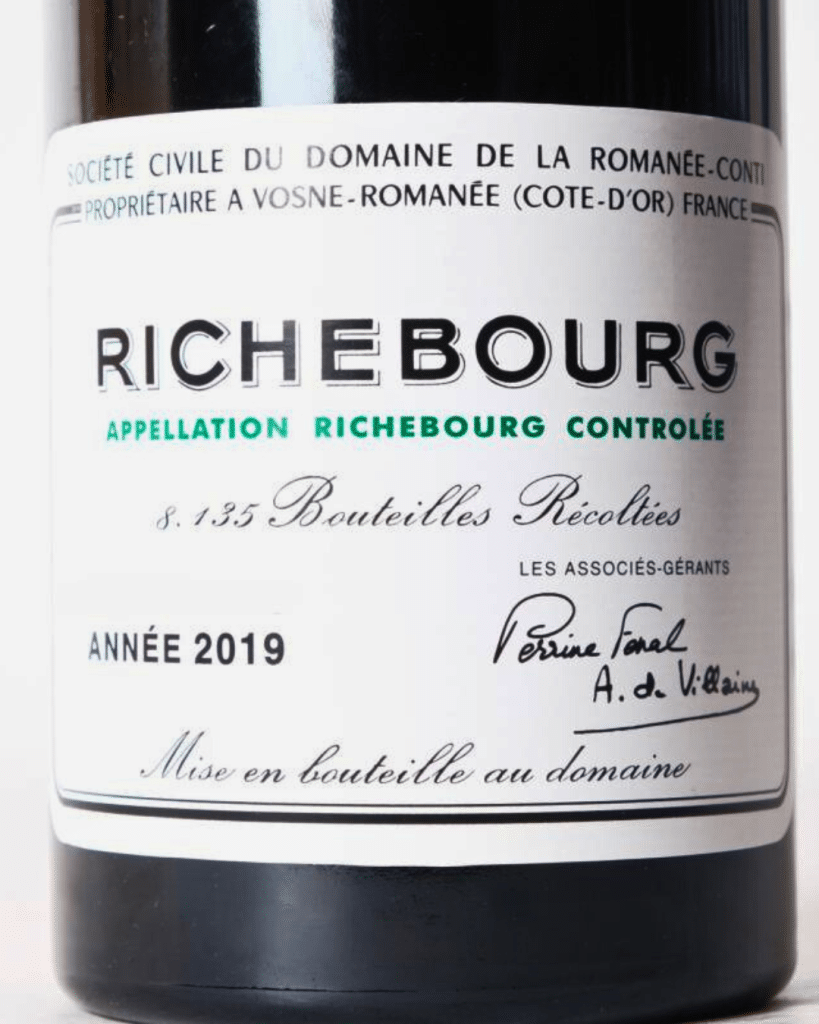

Our top five sales for September 2025 were:

- 2019 Domaine de la Romanee Conti Richebourg Grand Cru ($5,875.00)

- 1990 Jacques-Frederic Mugnier Musigny Grand Cru ($3,172.50)

- 2010 Domaine Comte Georges de Vogüé Musigny Grand Cru ‘Cuvee Vieilles Vignes’ ($1,527.50)

- 1996 Penfolds Grange Bin 95 Magnum ($1,292.50)

- 2009 Chateau Mouton Rothschild 1er Cru Classe ($1,233.75)

New Zealand

New Zealand wines represented 43% of our sales in October with nine of our top ten sales being large format bottles of Felton Road Pinot and the 10th being a magnum of the legendary 1998 Te Mata Coleraine. The top sale was 3l of 2017 Felton Road Block 5 Pinot Noir which sold for $799. Once again, over 40% of our New Zealand sales sold at $100 or over with 21 different producers represented (including wines from Hawkes Bay, Central Otago, Canterbury, Martinborough, Clevedon and Waiheke).

When it comes to 750ml bottles, our top sale was for a bottle of 2016 Bell Hill Pinot Noir ($340.75) which was followed by a bottle of 2022 Destiny Bay Magna Premia ($305.50) and 2009 Destiny Bay Mystae ($282.50) in second and third spot. Our Pinot Envy Auction featured an especially deep collection of Felton Road Pinot Noir (44 lots), with the proceeds from one large consignment going to Be Heard Foundation, a children’s mental health charity based in Dunedin.

We had several wines to watch including large format well-cellared Hawkes Bay Bordeaux Blends from Church Road and Corbans selling well above our highest estimates alongside Pinot Noir from Pegasus Bay and Felton Road, Chardonnay from Kumeu River and Te Mata and Riesling from Felton Road and Dry River.

Australia

Australia represented around 12% of our sales in October. Thanks to our consignors we were able to offer an incredibly interesting selection of classic Australian wines including a huge range of wines from Penfolds including 14 lots of Grange. Needless to say, alongside the Magnum mentioned in our top sales above, 9/10 out of our top sales were for Penfolds, either Grange or aged Bin 707, the outlier being a bottle of 2010 Clarendon Hills ($387.75). We also saw sales of wines from Moss Wood, Yarra Yering, Tolpuddle, Giaconda and Leeuwin Estate.

The Americas

We saw some healthy sales from the USA and Argentina including wines from Ridge, Dominus Estate, Hyde de Villaine and Cheval des Andes (owned by Cheval Blanc) however our top three sales were all single vineyard Malbecs from Cantena Zepata with a bottle of 2020 Catena Zapata Nicasia Malbec selling over our highest estimates.

France

French wine sales made up about 35% of our volume with especially strong sales from Burgundy taking the top three spots overall. We also saw good sales from Yquem, First Growth Bordeaux, Premier Cru Champagne and multiple vintages of Chave Hermitage Blanc. Alongside the Chave, bottles of 2016 Domaine Grand Veneur Chateauneuf du Pape and 2015 Chateau Grand Puy Lacoste sold significantly over our highest estimates.

Italy, Spain, Portugal and Germany

Italy dominated these our non-French old world sales, with our top sale being for 2005 Tenuta dell’ Ornellaia ($423) followed by 2012 Tiganello ($364.25) and third being shared by bottles of 2001 Falletto di Bruno Giacosa Barolo and 2018 Ornellaia Bolgheri Superiore ($352.50). After a few months with some quite significant Spanish sales we only saw a handful in October however there was strong demand for German Riesling.

Market Climate

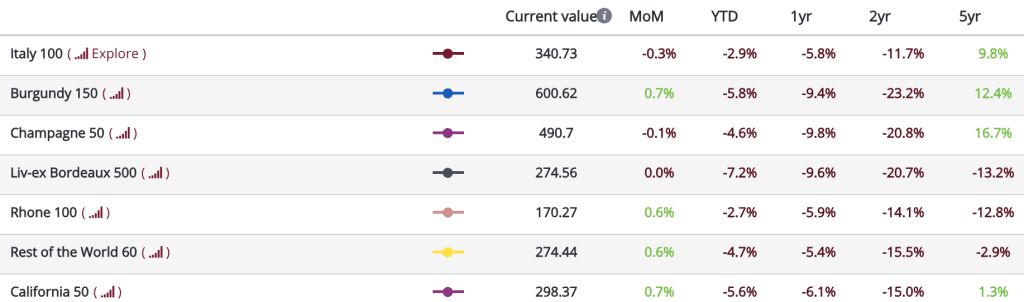

We are seeing similar trends in New Zealand, albeit on a smaller scale to similar international markets, we couldn’t put it any better than Cult Wine Investments when they state that, “Older vintages, value wines, and top names are driving demand despite lower prices.” They are also reporting that sales volume has grown significantly. Likewise Vinium is reporting that while the Liv-Ex top 100 is trading 1.1% up month on month AND 0.8% up pre-covid; Italy, Burgundy and Champagne are all performing extremely well.

Takeaways and Investment Advice

- While prices for investment wine are still down internationally (and here in New Zealand) trading activity has picked up considerably from the start of the year. This is a very positive indicator.

- Once again, we want to point out that there is always strong demand for well-aged good-value wines, as Cult Wine Investments states, “the wines that outperform are not the most famous names, but those offering strong relative value, high quality at a compelling price point.”

- Burgundy performed incredibly well in October both at The Wine Auction Room and internationally and the nature of these wines (small producers making multiple single vineyard wines) means they have genuine rather than manufactured rarity making them solid investment options. We have a spectacular single vendor auction with a Burgundy focus coming up if you want to add some depth to your investment (or drinking) portfolio.

And finally, it’s now November and it is getting warmer. We are forecast to have a warmer, La Niña summer so if you are sitting on investment level wines and don’t have temperature controlled storage it may be a good idea to transfer them to a facility like our Wine Storage Room – even if its just for the warmer months.

Please note, unless specified all prices are for 750ml equivalent bottles and include buyer premium. Retail prices, where quoted come from The Real Review or producer websites.