26 Aug New Zealand Pinot Noir – Special Market Report

With a view to giving all of our vendors, buyers and storage clients the most up to date and useful secondary market information possible, this is the first of a series of reports using our comprehensive sales data to focus in on one segment of the secondary market in New Zealand, in this case, New Zealand Pinot Noir.

Sales and Average Prices Over Time:

| Year | Lots Sold: | Bottles Sold: | Average Price: |

| 2020 | 204 | 345 | $56.41 |

| 2021 | 316 | 660 | $82.83 |

| 2022 | 307 | 678 | $103.33 |

| 2023 | 300 | 546 | $79.93 |

| 2024 | 292 | 552 | $86.68 |

| 2025 | – | – | $88.68 |

Between 2020 and 2021 we saw significant growth in the volume of sales of New Zealand Pinot Noir which held through 2022 but has fallen away slightly since 2023.

Likewise, we saw a huge increase in average prices between 2020 and 2022 (83% over two years), this is at the same time the secondary market as a whole was at record highs. Since 2022 prices have normalised however it is heartening to note that they have remained relatively high. For comparison, we recently reported that the Liv-Ex is up around 4% on early 2020 levels where New Zealand Pinot Noir sales at The Wine Auction Room are tracking at around 37% up across the same period.

Top Performers:

With the exception of large format bottles our top three sales for this period are as follows:

1) 3x 2019 Kusuda Pinot Noir selling at $611.00 per bottle in October 2022,

2) 2x 2016 Bell Hill Pinot Noir selling at $434.75 per bottle in October 2022, and

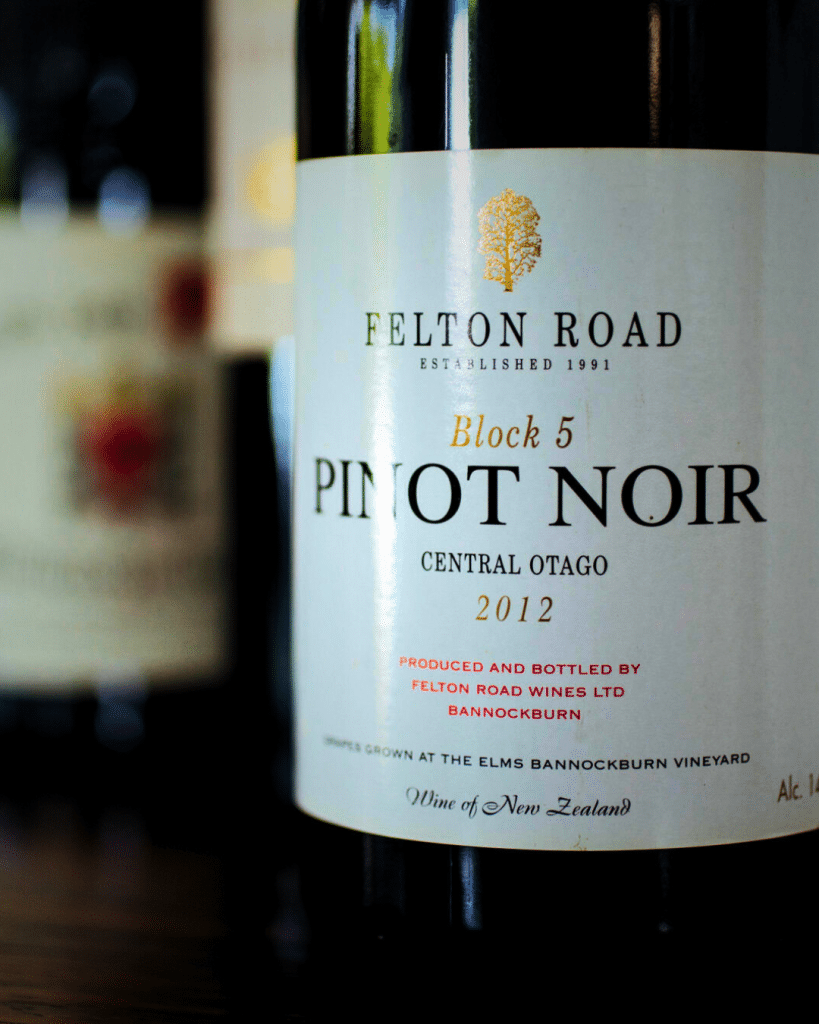

3) A four way tie with four lots selling at $411.25 per bottle; this includes two lots of 3x 2017 Felton Road Block 5 Pinot Noir (October 2021), 2x 2006 Bell Hill Pinot Noir (June 2025) and 2x 2019 Kusuda Pinot Noir (October 2024).

It is understandable (and notable) that all three of these producers make wine in incredibly small volumes of these wines (all less than around 10,000 bottles annually) and all are from very small vineyards or single blocks, putting a natural limit on production. This in combination with a strong track record in the cellar and excellent reviews from critics is a strong driver of demand and by extension prices.

If we look at all of our New Zealand Pinot Noir sales over the $200 mark, these three producers dominate, accounting for over 73% of sales (this includes sales of Felton Roads Block 3, which performs well). Other wines that make the list include Valli Gibbston Pinot Noir, Pyramid Valley (bottlings of Earth Smoke and Angel Flower made before the 2017 business and vineyard sale), Martinborough Vineyards (both the reserve wine, Marie Zelie and a 1988 estate bottling), Rippon Emma’s Block, Ata Rangi, and Amisfield Rocky Knoll Vineyard.

Older wines:

There is strong demand for older wines, both from benchmark producers but also from other solid producers with a strong track record.

If we take top prices out of the equation and look at the wines that have exceeded even our highest estimates, this list is dotted with well-cellared wines from the 90s, 2000s and early 2010s. While it only appeared once in the $200+ list, Ata Rangi dominates here with wines from the 90s and 2000s (and even late 80s) fetching solid prices, often well north of $150 a bottle. They are joined by wines from producers like Churton, Carrick and Olsen’s of Bannockburn (now Terra Sancta).

Regional and Vintage Trends:

Sadly, while we may get headlines for endorsing wines from a specific region the data doesn’t really do this. Likewise, vintage plays much less of a role in pricing as it does with top-flight Hawkes Bay or Waiheke Cabernet.

Conclusions, Investment and Cellaring Advice:

Here are our three takeaways if you’re looking to invest in New Zealand Pinot Noir.

1) Think Medium Term – While NZ Pinot is not (generally) going to be as long lived as Cabernet from great vintages, these are now serious, fine wines with proven aging potential. As such, look for wines that will last 10+ years, hold on to them and sell / drink them when the time is right.

2) Inflation is on your side – When people look at secondary market prices they often compare prices to current RRPs however the price and volume of fine NZ wine has risen faster than even our much bemoaned inflation levels. For example, in 2017 Bob Campbell MW reported that there were 38 New Zealand wines that retailed for over $100, 13 of which were Pinot Noir, just over five years later this jumped to 99 wines, ⅓ of which are Pinot Noir. Bringing this back to secondary prices, we looked at all of the sales of ten year old Pinot Noir that we made this year and on average they sold for 22% higher than their original retail prices.

3) Buy wines that offer value today – Ata Rangi Pinot Noir is an excellent example of this. It retails for under $90 a bottle but in the last three years has sold for an average of $116 across all vintages. If we look at 2017, the most often traded vintage over this period, this wine had a $75 release price but has sold for an average of $105 between 2023 and 2025, an increase of 40% in less than six years (it was released mid-2019).

Please note, unless specified all prices are for 750ml equivalent bottles and include buyer premium. Retail prices, where quoted come from The Real Review.

* Our very highest-selling NZ Pinot Noir lot was a 3l of 2018 Felton Road Block 3 Pinot Noir which sold for $2,408.75 in October 2021.